Tesla Stock: A Comprehensive Overview for Car Enthusiasts

Introduction

Tesla stock is a popular investment choice among car enthusiasts and investors alike. This article aims to provide a detailed overview of Tesla stock, including its types, popularity, quantitative measurements, differences, and historical pros and cons.

Overview of Tesla Stock

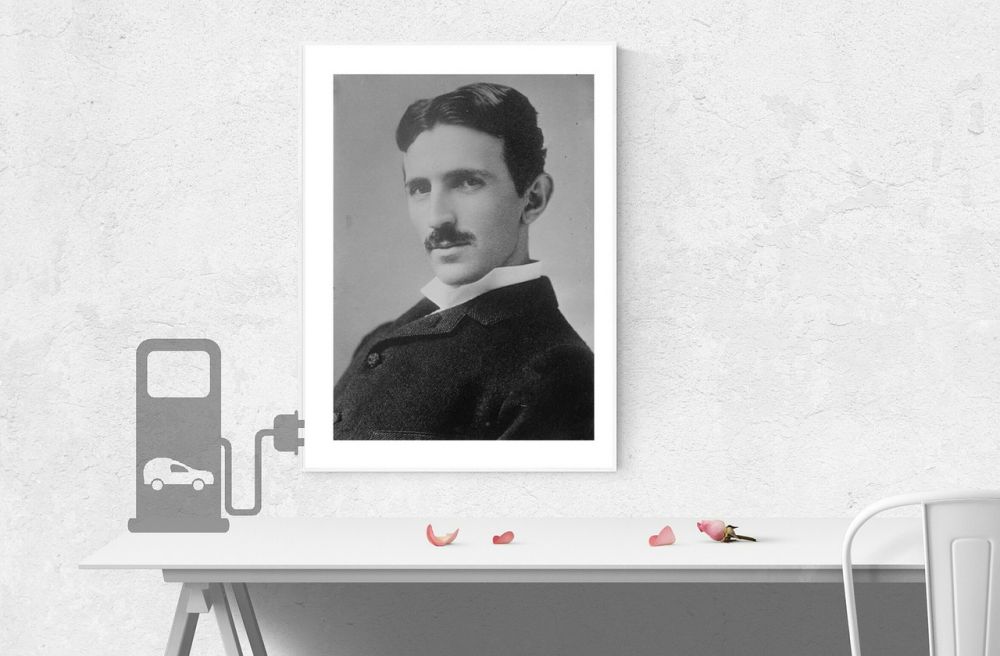

Tesla stock refers to shares in Tesla, Inc., an American electric vehicle and clean energy company founded by Elon Musk. The company went public in June 2010, offering shares on the NASDAQ stock exchange. Tesla stock provides investors with the opportunity to own a piece of this innovative company and participate in its potential growth and success.

Types of Tesla Stock

There are two primary types of Tesla stock: common stock and preferred stock. Common stock represents ownership in Tesla and provides voting rights in corporate decisions. Preferred stock, on the other hand, does not come with voting rights but is given priority in receiving dividends. Both types of stock offer potential capital appreciation.

Popularity of Tesla Stock

Tesla stock has gained immense popularity over the years due to the company’s groundbreaking electric vehicle technology and its charismatic leader, Elon Musk. The stock has attracted a wide range of investors, including car enthusiasts who believe in the future of sustainable transportation and those who recognize the potential for significant financial returns.

Quantitative Measurements of Tesla Stock

Several quantitative measurements can help investors analyze and evaluate Tesla stock. These include stock price, market capitalization, earnings per share (EPS), price-to-earnings ratio (P/E), and revenue growth. By examining these metrics, investors can gain insights into the financial health and performance of Tesla as a company.

Differences among Tesla Stock

Tesla stock can vary based on its class and market position. For example, Class A shares carry voting rights, while Class B shares do not. Additionally, differences can arise between Tesla stock listed on different stock exchanges or available through different investment platforms. It is crucial for investors to understand these distinctions when considering investing in Tesla stock.

Historical Pros and Cons of Tesla Stock

Over the years, Tesla stock has experienced both benefits and drawbacks. On one hand, early investors have seen significant returns as the company revolutionized the electric vehicle industry. Tesla’s stock price has soared, contributing to overall gains for shareholders. On the other hand, the stock has been volatile, and its valuation has at times been called into question, leading to occasional price fluctuations and uncertainties.

In conclusion, Tesla stock offers car enthusiasts and investors an opportunity to participate in the success of a pioneering electric vehicle company. It is crucial for potential investors to thoroughly understand the different types of Tesla stock, analyze quantitative measurements, and consider historical pros and cons. By doing so, individuals can make informed decisions when investing in Tesla stock and potentially benefit from the future growth of the company.